Fintechzoom has emerged as a crucial platform for investors seeking real-time financial updates, stock data, and market insights. Among its extensive coverage, Microsoft Corporation (MSFT) is one of the most prominently featured companies.

With its role as a global tech leader, Microsoft’s stock performance significantly influences the broader market, making Fintechzoom’s insights particularly valuable for investors and market analysts.

Introduction to Fintechzoom and MSFT Stocks

Fintechzoom provides a one-stop platform for investors seeking insights into stock performance, real-time prices, historical data, analyst ratings, press releases, and more. Its focus on Microsoft Corporation (MSFT) is particularly significant due to the company’s strong presence in the tech industry. With Fintechzoom’s tools, investors can gain detailed insights into MSFT’s stock, making it easier to make informed investment decisions.

Microsoft, a dominant player in the tech industry, continues to have a significant impact on global markets. As one of the world’s most valuable companies, its stock performance is closely monitored. Fintechzoom’s MSFT stock coverage offers users up-to-date data, which includes detailed charts, historical stock prices, expert analysis, and more, providing an all-encompassing view of Microsoft’s market trajectory.

Microsoft Stock Performance

Microsoft’s stock performance is widely recognized for its impressive growth trajectory. As of 2024, MSFT shares have demonstrated a remarkable return of 22.42% annually on average, though the volatility (with a standard deviation of 35.61%) shows significant fluctuations in its price history. From $55 per share in 2016, Microsoft’s stock price surged to $250 per share in 2021, and currently, it stands at $423.08.

This upward trend reflects a combination of technological advancements, consistent financial growth, and a strong market position. Investors have been drawn to MSFT not only due to its financial performance but also its leading role in transformative sectors like cloud computing and artificial intelligence (AI).

Check the Microsoft Stock Performance table:

| Year | Stock Price (USD) | Annual % Change | Key Events |

| 2016 | $55.00 | +7.40% | Continued strong growth in cloud and enterprise services |

| 2017 | $70.00 | +27.27% | Expansion of Azure and increasing demand for cloud solutions |

| 2018 | $100.00 | +42.86% | Significant growth in cloud services and acquisition of LinkedIn |

| 2019 | $135.00 | +35.00% | Launch of Microsoft Teams, further cloud growth |

| 2020 | $200.00 | +48.00% | Pandemic-driven demand for remote work tools, cloud services surge |

| 2021 | $250.00 | +25.00% | Record earnings, continued strong performance of Azure and Office 365 |

| 2022 | $280.00 | +12.00% | Strong focus on AI and cloud expansion |

| 2023 | $350.00 | +25.00% | Partnership with OpenAI, increased focus on artificial intelligence |

| 2024 | $423.08 | +21.00% | Consistent growth in cloud computing, AI, and new product releases |

Current Trends and Market Sentiments

Microsoft’s position as a market leader is bolstered by its investment in key areas such as cloud computing, AI, and digital transformation. These sectors are pivotal to its growth and stock market performance.

Key Trends Affecting MSFT Stock:

- Cloud Computing: As demand for cloud solutions continues to rise, Microsoft’s Azure platform plays a vital role in its revenue streams.

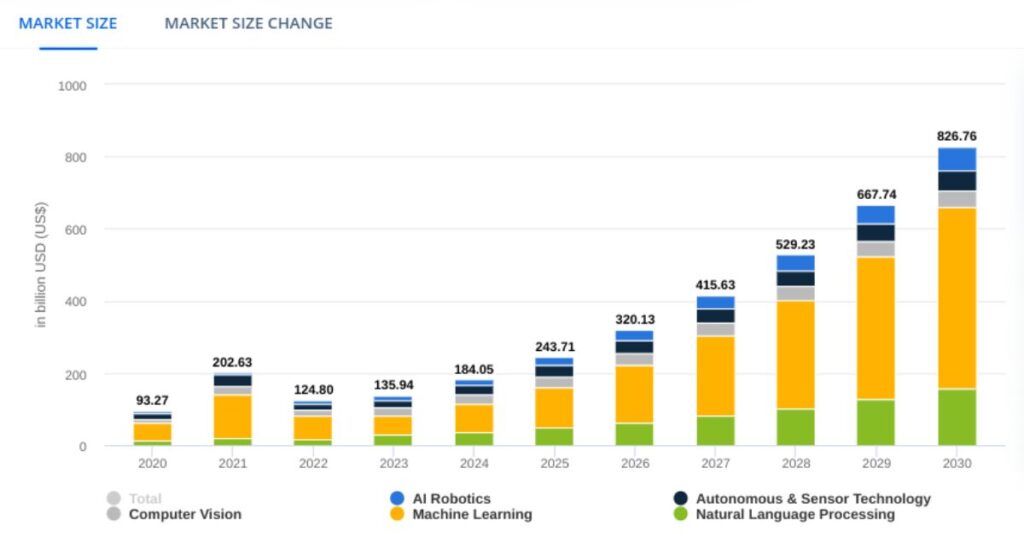

- Artificial Intelligence (AI): Microsoft’s integration of AI technologies, such as ChatGPT and other machine learning tools, positions it at the forefront of the AI revolution.

- Product Diversification: From gaming with Xbox to new Surface devices, Microsoft’s product range ensures it can weather fluctuations in specific markets.

- Digital Transformation: The company helps organizations transition to digital operations, driving demand for Microsoft tools like Microsoft 365 and Teams.

Market sentiment for MSFT remains optimistic, driven by strong economic indicators, consistent innovation, and positive earnings growth. However, it’s essential for investors to remain cautious as market conditions can shift quickly.

Read More Blog: Investment Fintechzoom: Making Investment Easy for Everyone

Factors Influencing MSFT Stock

Several factors can affect the performance of MSFT stock. Investors need to keep an eye on the following variables:

1. New Product Launches

Successful launches, such as new versions of Windows or enhancements to Azure, can boost stock prices. However, delays or failures might lead to a dip in stock value.

2. Competition and Market Share

Microsoft competes with other tech giants like Google, Amazon, and Apple. Changes in the competitive landscape could influence MSFT’s market share and stock performance.

3. Macroeconomic Factors

Global economic conditions, such as GDP growth, inflation, and geopolitical events, play a pivotal role in stock price movements. A strong economy typically benefits MSFT, while economic downturns could have adverse effects.

4. Investor Sentiment

Stock prices are influenced by the collective sentiment of investors. Positive market sentiment often leads to higher prices, while negativity can result in a decline.

5. Regulatory and Legal Factors

Microsoft is subject to various regulations, especially concerning antitrust laws and data privacy. Any legal challenges could impact stock prices negatively.

6. Financial Performance

Investors closely follow Microsoft’s earnings reports, revenue growth, and profitability. Strong financial performance is generally a good indicator of future stock growth.

Fintechzoom’s Analytical Approach to MSFT Stock

Fintechzoom leverages advanced tools and methodologies to provide an in-depth analysis of Microsoft’s stock. This includes evaluating multiple data points to offer a holistic view of MSFT’s stock performance.

Key Evaluation Criteria:

- Momentum Score: Measures the momentum of MSFT stock price, considering factors like trading volume, price fluctuations, and volatility.

- Overall Rating: A comprehensive score reflecting the company’s growth potential, based on revenue, earnings, and stock performance.

- Growth Score: Assesses MSFT’s long-term growth prospects, factoring in areas like revenue growth, profit margins, and cash flow.

Expert Forecasts and Predictions

Chart Patterns:

Current chart patterns for MSFT stock show a bullish trend, with an ascending triangle formation, indicating potential for a breakout above the $490 price point.

Moving Average:

MSFT stock is currently trading above both the 50-day and 200-day moving averages, signaling strong upward momentum.

Relative Strength Index (RSI):

With an RSI above 70, MSFT stock is considered overbought, suggesting the potential for a short-term pullback.

Price Forecasts:

Analysts project that MSFT’s stock price will reach an average target of $470.26 over the next year, with a long-term target of $769.36 by 2029.

Market Volatility and MSFT

The stock market has seen volatility in recent years, particularly during the COVID-19 pandemic. Despite the global crisis, Microsoft’s stock performed admirably, thanks to its cloud services and remote work solutions.

Key Strategies During Crisis:

- Cloud Computing Expansion: MSFT saw increased demand for Azure and Microsoft 365 as businesses transitioned to remote work.

- Gaming: The company launched new games and consoles, providing entertainment during lockdowns.

- Partnerships: Microsoft formed strategic partnerships, ensuring steady growth and diversification of offerings.

These strategies helped Microsoft maintain a strong balance sheet during uncertain times.

Microsoft’s Expansion into Emerging Technologies

Microsoft is aggressively investing in Artificial Intelligence (AI), quantum computing, and other cutting-edge technologies. These investments are expected to enhance its market position and stock performance in the long term.

- AI: Microsoft’s partnerships with companies like OpenAI are positioning it as a leader in AI innovation.

- Quantum Computing: The company is also pioneering advancements in quantum computing, ensuring it remains competitive in the tech industry.

These innovations are integral to Microsoft’s long-term success, which directly influences its stock performance.

Frequently Asked Questions (FAQs)

What are the risks of investing in MSFT stocks?

Market volatility, economic downturns, and legal/regulatory challenges could impact MSFT stock prices.

How does Microsoft’s AI investment affect its stock?

Microsoft’s strong investments in AI help secure its position as a leader in innovation, boosting long-term stock value.

What is the outlook for MSFT stock in 2024?

Experts predict MSFT’s stock to hit an average target of $470.26, with potential growth driven by cloud and AI advancements.

Is Microsoft stock a safe investment?

While MSFT stocks are relatively stable, all investments come with risks. The company’s strong fundamentals and growth prospects make it a solid long-term investment.

How can I track MSFT stock performance?

Platforms like Fintechzoom offer real-time updates, including price charts, financial data, and expert analysis, to help investors stay informed.

Conclusion

Investing in MSFT stocks presents an opportunity for growth, especially for those looking to invest in a leading technology company. Microsoft’s strong performance, innovative capabilities, and strategic expansion into emerging technologies like AI and cloud computing make it a compelling choice for investors.

However, as with any investment, it’s essential to stay informed about market trends, economic conditions, and company performance. By following platforms like Fintechzoom, investors can ensure they have access to reliable, real-time data to make well-informed investment decisions.

Streamnexs.com offers a creative collection of Animal and Bird Name Ideas, helping pet owners, enthusiasts, and Bird Lovers Find Unique, Meaningful, and Fitting Names for their Feathered and Furry Friends.